★ Climate Change ★ The Smart Grid ★ Universal Basic Income ★ The Automation Crisis ★

Inevitable Unemployment and the Resulting Liquidity Crunch

ϕ The Capacity of the Crisis to Elude Understanding

ϕ America Must Guard the Economic Status Quo

ϕ Why Is This Crisis Different?

ϕ The Strongest System-Wide Dynamics in this Crisis

Ten Major Factors

ϕ Geoeconomic Dynamics of Automation and Unemployment

ϕ Policy Response: Strategy, Perception, Timing and Pacing

ϕ Commodity Markets and Resource Distribution

ϕ Technology’s Impact on Commodity Markets

ϕ Distribution and Control of Foreign Direct Investment

ϕ Forex Dynamics and Foreign Currency Reserve Distribution

ϕ Bond Markets React Poorly to Inflation

ϕ Distribution of Debt

ϕ Entitlements, Median Income and Population Flux

ϕ Unpredictable Geoeconomic Trends Via Climate Change

We Are Not Out of the Woods Yet

ϕ Policy Must Account For Domestic and Foreign Political Reaction

ϕ Counting on Downward CPI Pressure is Wishful Thinking

ϕ Avoid Hacking Economics for Short-Term Gain

ϕ Strategic Allocation of Liquidity in the 2020’s

ϕ Interest Rates And Federal Reserve Policy

ϕ International Economic Development

ϕ Currency Market Stabalization

ϕ ‘Ethereum for IRL Labor’ as a Currency Stabilization Mechanism

ϕ Flexible Management of Existing Debt

ϕ Enslavement by Debt and Desire

ϕ Student Load Reform and Innovation in Higher Education

ϕ Even With Inflationary Measures, There is Still Systemic Collapse

ϕ Gold and Silver

ϕ Policy Must Account for Disinformation in the Age of Social Media

ϕ Revolution is Expensive and the Opportunity Cost is Unacceptable

ϕ What Side Do You Want To Be On Anyways?

None of this should be taken as investment advice, of course. Any assertions I make should be backed up by data and further analysis. I have more questions than answers, but the more I look into this, the worse I feel about it.

Inevitable Unemployment and the Resulting Liquidity Crunch

There is an economic crisis brewing. As automation drives unemployment, governments will be forced to respond with policy: either Universal Basic Income or Employer of Last Resort. Regardless of the economic and sociocultural merits of UBI versus ELR, neither policy is sufficient to stave off unemployment’s effects on revenue streams to banks. In turn, this triggers several downstream effects, including a major reduction in liquidity available to banks and a major slowdown in consumer and corporate lending. These effects come at a poor time.

To cope with the unemployment and economic turbulence, developed nations are compelled to borrow money to prop up the economy. The greater the scope of entitlement programs, the more the currency must be diluted in response. With numbers pulled directly out of my ass, by 2030, America could reach 20-100% annual growth of the national debt, dependent on rates of unemployment and tax volume. Imagine the effect that would have on currency markets, economic development and lending institutions.

The Capacity of the Crisis to Elude Understanding

The upcoming crisis is unlike any before. Even though it shares many of the same components, it is fundamentally different in ways that will elude many economists. I do not have the data or the expertise to predict how this will unfold, nor does anyone. It is not necessarily disastrous for America or the global economy, but there is significant potential for disruption. Again, it is not necessarily the magnitude of the crisis which is worrying, but the acceleration in economic trends along with qualitative aspects of the crisis that will cause itq to elude understanding, triggering poor reaction among nations.

America Must Guard the Economic Status Quo

It’s critical to keep in mind that America dominates the economic status quo now. Therefore, all other powers have a greater incentive to disrupt the status quo than we do in maintaining it. For them, it is easier to disrupt than it is for us to maintain. Foreign interests and information warfare have subverted American leftists into attacking the fundamentals of American prosperity. They don’t realize that it is American prosperity that provides the possibility of expansive social programs. Without these economic interests intact, the question is no longer whether we should finance entitlement programs, but whether we can at all.

Why Is This Crisis Different?

There isn’t enough liquidity and wealth distribution for people to keep up with their debt. Therefore, this is a deflationary depression where inflationary measures are appealing to inject liquidity into the economy and relieve unemployment. Such inflationary measures include UBI and ELR. In doing so, the finance of budget deficits both with and without credit drives inflation. These contribute to systemic instability in global currency markets. But unlike most depressions, various means of production should remain elevated through the use of technology. Because of automation’s inversion of labor markets, this furthers income distribution disparity, since the profits fall into singularly fewer hands. The 21st century economy rapidly converges into the control of fewer because of the nature of information and intellectual property.

If we don’t play our cards right, constricted liquidity implies that the outlook on economic expansion is bleak, so it cannot be assumed that increased profits will lead to increased tax volume to finance the governmental policy response. In this case, increased tax rates will also be insufficient. The liquidity to invest in smart-grid infrastructure and the development of emerging markets will be restricted. Further complicating matters, nations often respond to depressionary crises with warfare to artificially stimulate of economic activity and expansion. This creates geopolitical instability at the same time as global economic crisis.

The Singularity’s technology trends drive the global economy to converge towards a more final state. This crisis represents a tumultuous transition towards economic convergence, but may spiral out of control, especially without cooperation.

Dali’s Work on Service-Oriented Economies

The Strongest System-Wide Dynamics

Artificial intelligence, fabriction and other technology drive unemployment. High rates of unemployment drastically lower median income in developed nations. These economies have higher debt saturation on consumers, which ostensibly enables faster growth, but this dependency on already established revenue streams leads to greater surface area for systemic risk. These higher levels of debt saturation lead to more severely constricted liquidity in situations of lowered employment. The lost liquidity leads to fewer new investments and less capability to develop economic opportunities to rise oneself out of crisis.

As opposed to other crises, restoring income distribution cannot be assumed to be possible through new employment opportunities. The employment will never be restored. Therefore, social programs must be sustained through high tax volume via highly profitable private & state enterprise. That which cannot be supported through enterprise must be borrowed or even literally printed by the government. However it can be provided, the people will be asking for it and expecting more of it. High levels of unemployment lead to lots of idle people who vent their unrest on the internet and demand more expansive programs.

The dependency on expansive social programs, debt-backed or not, leads to currency stability issues. This resulting inflation leads to poor performance in bond markets, which impedes debt security options for central banking. In the past, currency dynamics were mostly restricted to a small number of currencies at the same time in the global system. Yet, here, you have these disruptive dynamics occuring system-wide. Because of that, there is a high likelihood of several simultaneous positive feedback loops in forex markets. These multiply turbulence and cause massive amounts of wealth to evaporate. These forex dynamics and massive redistributions of wealth will strongly shape world politics.

All of these factors can lead to war, but the unpredictable, global currency dynamics in particular. War & unrest lead to more of both. These negatively impact the climate, fueling unpredictable changes in agriculture and water availability, thereby influencing real estate markets. Unpredictability in itself leads to behavior to anticipate & mitigate unpredictability. Addressing climate change requires limiting economic development through government spending and diversion of liquidity.

Technology changes commodity markets and demand for resources. Those with broader portfolios can spead out their risk amoung more foreign direct investments, currency holdings and asset holdings. High leverage on capital available to investors could limit exposure to systemic problems in the currency markets.

Ten Major Factors

This is an overview of ten major factors that act as components to the development and outcome of the crisis. These factors are not listed in order of significance because the system is non-linear and these factors effects, dynamics and magnitudes are thus interdependent.

Geoeconomic Dynamics of Automation and Unemployment

From the perspective of a behavioral economist, this factor is the most important in predicting the common person’s response, both financially and politically, as well as their needs at the time the crisis begins unfolding in their nation and region. The geoeconomic dynamics drives their change in economic circumstance, their overall perception of the crisis and thus their political reaction to it.

How do the trends in employment differ for developed and developing economies? What does it mean for a rising China and its economic competition with the West? What does it mean for America and the EU?

The geoeconomic dynamics contribute towards dynamics which invert globalization’s impact on manufactoring, without restoring American labor markets. That is, American manufacturing is more likely to move home, but that doesn’t restore lost jobs or the disrupted wealth distribution that accompanied globalization.

How does the gradual impact to income distribution progress over various regions of the US? Can the progression of unemployment be accurately anticipated?

The impact on manufacturing, in particular, is constrained to the phenomenological limits of artificial intelligence, 3D printing and nano-technology. These are bounded by complexity theory and methods of fabrication. For example, the nano-revolution is impossible when materials like graphene and buckyballs can only be produced in laboratory quantities.

There are many business innovation opportunities that become available once vehicles and transportation is automated. Once the policy groundwork has been laid for automated driving, products like Otto can overtake product delivery both near and far. Automated driving will disrupt retail as well as delivery services like Instacart, but there is a several-year lag in between the federal policy implementation and the development of innovation based on it. As soon as this is policy is determined and implemented, corporations will begin to restructure themselves around it. Food can almost be automated from farm to table and the existing grocery store retail space will almost entirely become warehouse space for local distribution. The higher wages are, the greater the incentive is for corporations to react faster. So, after 2020, higher wage actually cause unemployment in low income segments to accelerate.

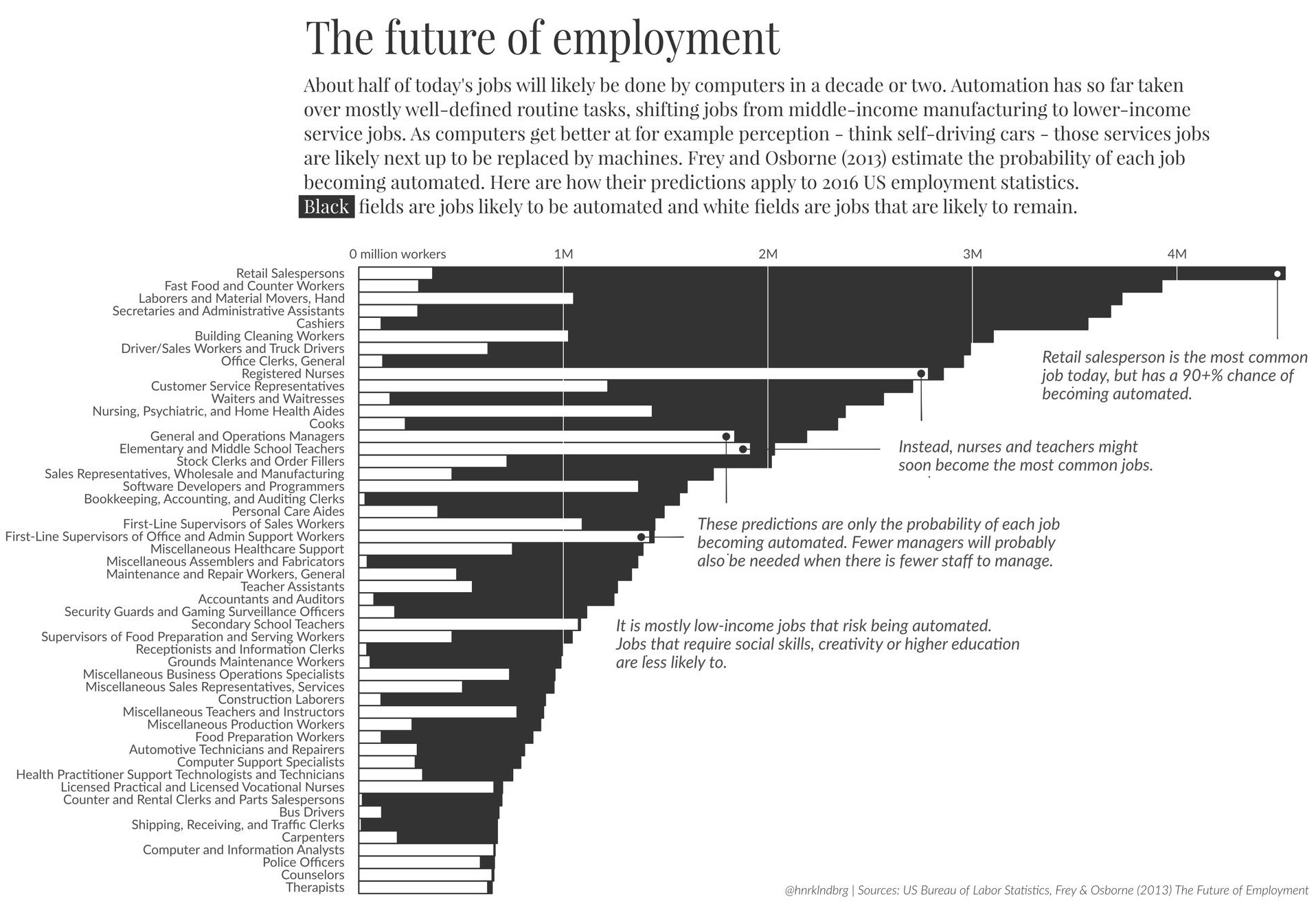

@hnrklndbrg’s Graph Estimating the Likelihood a Job Will Be Automated

The impact on white-collar jobs is dependent on the range and complexity of tasks involved in each job type. Henrik Lindberg’s chart above predicts that many of these will be automated. Particularly interesting are the management segments of the labor market, whose demand will suffer upon logistic restructuring of the consumer-facing segments of corporations. That is, retail employees are mostly laid off, therefore, less direct and middle-management are required.

Policy Response: Strategy, Perception, Timing and Pacing

What policy responses are available? Mostly UBI and Employer of Last Resort. When considering a policy response, the most important factor is the path to transitioning into the policy. What transition paths are available from where we are? What is the proper timing? How is the policy legally formulated to offer malleability and redundancy in timing the implementation? What are the opportunity costs?

What policy responses are appealing? The available and appealing responses for major players should be delineated and evaluated upon economic, sociocultural and geopolitical dimensions. In general, which options are available for developed or underdeveloped economies? How are failed states going to respond in their region? Will this force a general contraction of soft/hard power via strong, developed states? Or will the forced reliance on economic opportunitiy force states into responding by projecting soft power? How does a rising China respond? with the Belt and Road strategy for soft power?

Every government in a developed economy needs a policy response. The more highly developed the economy, The sooner the resulting unemployment and the higher that consumer and corporate debt holdings will typically become. In its aggregate, poor central banking policy across the globe will disrupt currency markets.

I’ve already written at length about the choice between UBI and ELR. The latter represents a job guarantee and, depending on what that entails and how it’s implemented can lead to cost savings, where people share resources. However, both represent a massive strain on the federal government and result in strong new dynamics affecting domestic economic behavior.

The costs and benefits of each will differ depending on how developed the nation’s economy is. Highly developed with lots of cash: UBI will seem more appealing. Highly developed economies with corporations that don’t remain globally competitive results in a strong downward pressure on tax volume.

The UBI proponents seem to think that everything will be fine if enough factors of their choosing remain stable, while other factors that lend credit to their ideas are adopted in mass. In a fundamentally different economy that behaves in unexpected ways, how can we be sure that we can influence or mitigate unwanted dynamics. we cannot leave this up to chance. Ihis contradicts occam’s razor. you’re assuming that random chance will land in your favor every single time for dozens of different factors, the effect of which cannot be predicted.

Maybe we should pray that the economy selectively mitigates all the negative sources of change while millions of people voluntarily change their behavior posivitly without compelling incentivization to do so: dear God, please protect us from liberal economy policy when it fails catastrophically.

Monetary Policy

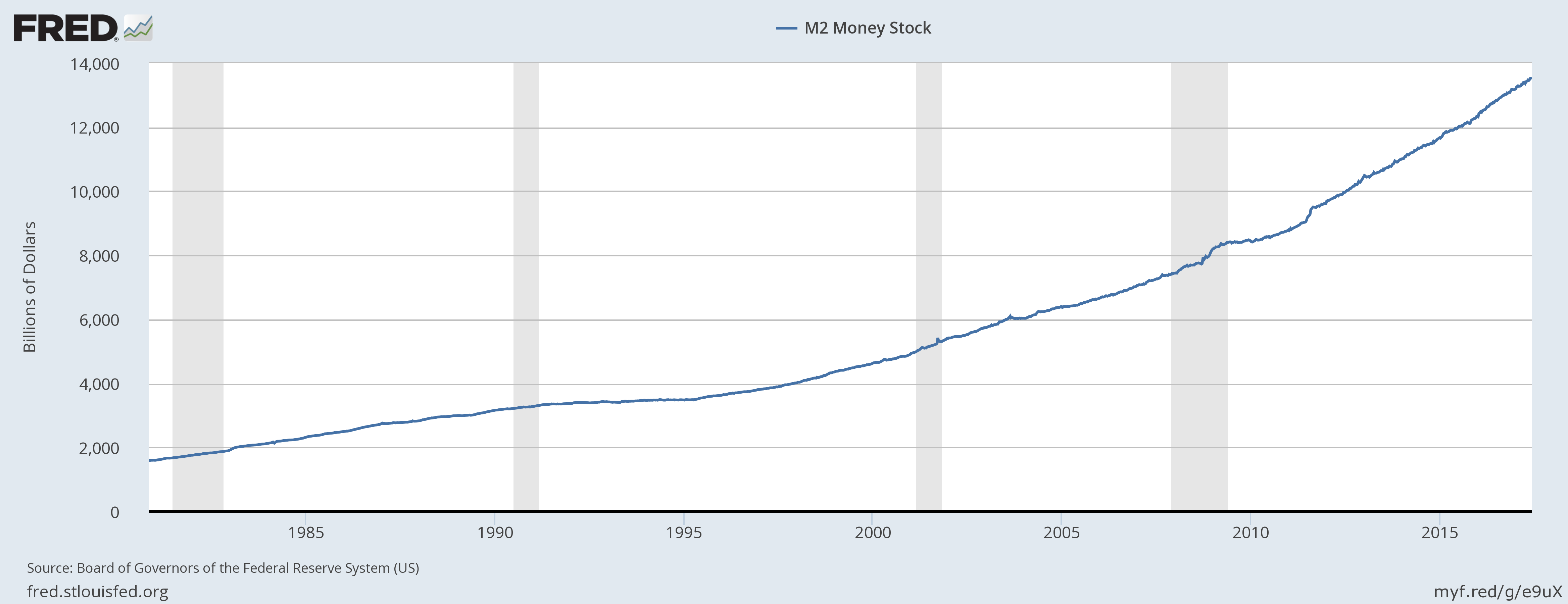

A critical measure for domestic policy is the size of monetary supply in relation to annual federal deficits. Inflation-driven economic policy is highly unsustainable and will tank the credit ratings of nations. Since 2006, the Fed has ceased publishing the M3 money supply numbers.

The M2 money supply measure is at approximately $13.5 Trillion

Please tell me more about how inflation is not a concern when poor bond markets reduce the Fed’s capacity to influence debt markets. This occurs at the same time that we’ll need to depend on foreign debt to maintain large deficits, since the effects will ripple back through the Fed into the US Treasury bond markets. Because the national debt is high and it’s likely to continue growing, this means foreign powers have more influence than ever over US policy.

Tax Policy

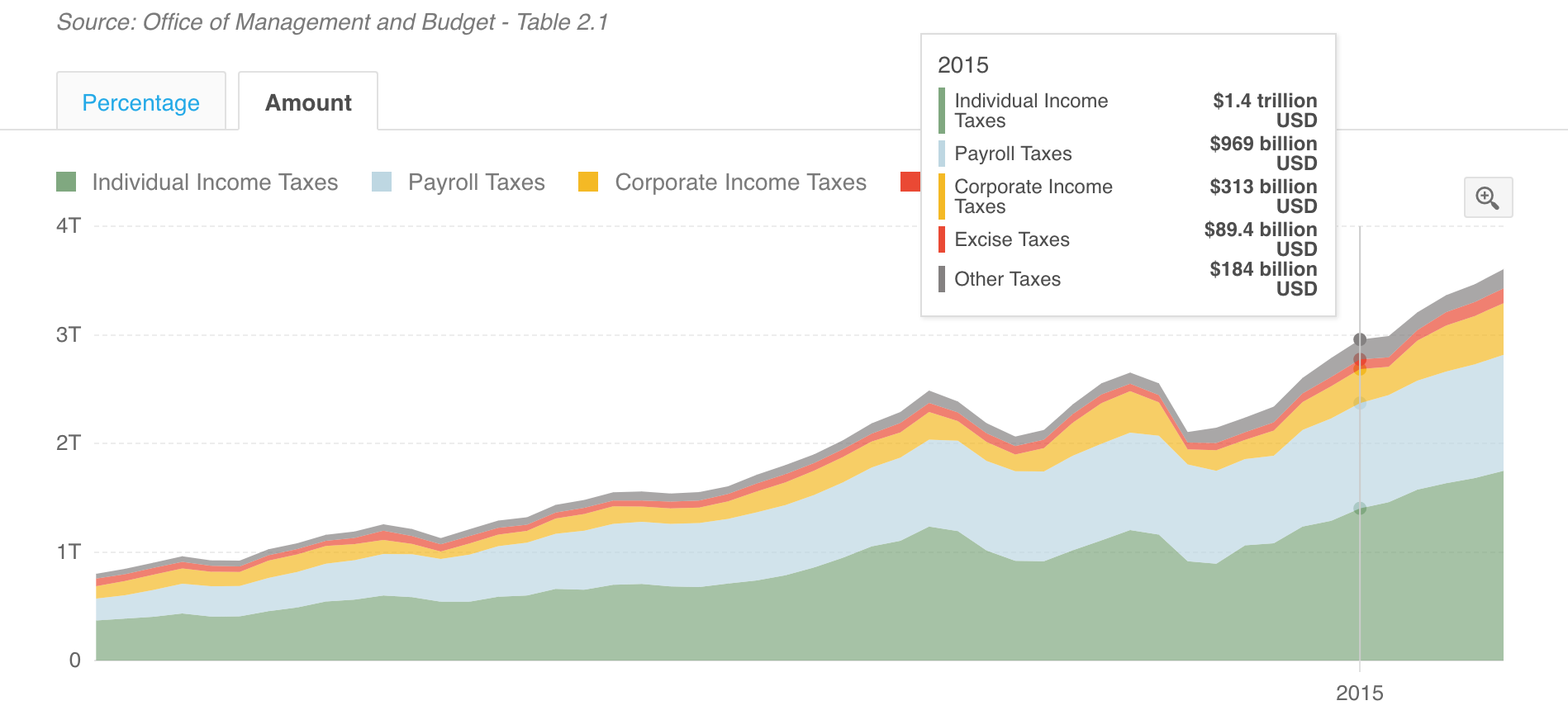

Drastic changes in tax policy are required, both to finance a policy we can’t afford and to offset the loss of personal income taxes via unemployment. About 50% of the budget comes from individual income taxes.

2015 United States Budget

These revenue streams via personal income tax will mostly be replaced on par with unemployment. In and of itself, that require major tax policy changes, just to sustain current federal spending levels. with UBI, each of these revenue streams is offset with the cost of providing a citizen UBI. With 250 million adult citizens, that would be an extra $2.5T to the budget for a $10,000 UBI payment. So, given 30% unemployment, not only would the government lose ~30% of the individual income tax revenue streams, but it must provide a service that costs 2 times as much as citizens paid in taxes in 2015. Further, to cover the difference, corporations would need to pay six times as much in total tax volume.

GLHF

Automation Tax Policy

Taxing automation is a good update to policy, but how do we fairly determine what is taxably automated labor? How do we do so without overly burdening tax policy and the resulting bureaucratic death-by-legalism? Does it require many difficult-to-understand, ever-shifting, impossible-to-anticipate changes in regulation? I admit, taxing automation is a good idea because simply raising tax rates would destroy small businesses.

Can we ever assume that enough tax volume would be produced to cover other domestic policy responses, like UBI or ELR? I don’t think so, but I’d love to evaluate ideas for doing so.

Update: Should Robots Pay Taxes? Tax Policy in the Age of Automation is a great article from the Harvard Law & Policy Review that explores the complexities of this issue. A fair & balanced approach to taxing corporations must be properly structured legally. The updated policy must be at least revenue neutral if we are to have any hope of sustaining current government expenditures. Many suggestions I have seen are either overbearing, requiring too many details, or would not work in practice because the taxation would simply be evaded. The challenge in identifying a fair and practical tax policy is immense.

Popular Response to Policy

America is a democracy with a developed economy and decades of prosperity. What are the people’s attitudes to being compelled to work harder for less? What triggered globalization to shift labor overseas? Highly liberal? The inverse of Kennedy’s maxim prevails: ask what the government can do to fix your problems or protest.

Compelling Popular Response to Policy and Coordinating a Well-Executed Strategy

Democracies are highly disadvantaged in this regard because they cannot compel people to contribute to concerted economic strategy. Additionally, the people are easily subverted against themselves by foreign powers. Thus, economic and information warfare become increasingly appealing to adversaries.

Democracies with decentralized communication will find it much tougher to control narrative. They will be less able to ensure that the population responds with an aggregate force of unity instead of mostly cancelled-out net potential for change. The slower parliamentary and procedural processes in democracies will become more vulnerable to external subversion as well. We just experienced this with potential Russian interference in the election.

Regardless of whether we need authoritarian measures to get it, we need tighter control of information in general. Hopefully we don’t need to resort to such measures, but encouraging popular action via patriotism is the only such mechanism I can think of to compensate for the lack of centralized agency determining action. That is, to compel the coordination required in a well-executed strategy, this requires more constricted agency determining action throughout the political or economic system. A smaller set of nodes making a more expansive set of decisions is needed, while the other nodes willingly cooperate and anticipate shifting intent. As the American and European systems are currently operating, no action results because all change is effectively cancelled out by the stagnant momentum of conflicting interests and intention.

This is why authoritarian countries are at an advantage here. They can leverage control over information to mitigate the range of negative impact resulting from mixed messaging and foreign influence. Unraveling parts net neutrality may be helpful in this regard, though I’m not sure it counters other negative consequences of doing so.

When debate over domestic policy is decided upon primarily emotional arguments citing anecdotal needs to help the poor, how do we assess sustainability of a developed nations’ credit-driven policies? Reliance on inflation-driven policy can be mitigated through higher tax volume obtained through highly competitive enterprise. Still, in a closed system, one nation’s economic expansion comes at the cost of another’s lost opportunities to do the same.

Commodity Markets and Resource Distribution

How does geographic distribution of resources precipitate conflict or commerce and how does it alter the fortunes of nations? How do resources from space alter the equation? And if the primary tier of resource streams from space are controlled by private entities, how does this change resource distribution, its pricing and intergovernmental dynamics? Some space-commerce corporations will form transnational entities which parallel governments. This should provide them with the option to selectively influence commodity price dynamics in sufficient quantities. This ability will be mitigated without a monopoly on the business platform for operation in space.

The global economy, which would otherwise be energy-bound becomes resource-bound. This defining trait becomes more pronounced as we approach the singularity and the next technology plateau. It’s propensity to define dynamics in commodity markets depends on the functional limits of fabrication technology. What is clear is that more proficient fabrication leads to more self-reliant economies, assuming they have the intellectual property and ability to build out industrial capacity. Energy is required to offset entropy of starting materials and industrial capacity is required to offset the production time required for fabrication. (i.e. 3D printing and nanotech are slow, therefore more industrial capacity is required to offset time)

Supply chains then become more compact. Supply of ore and smelting will always be required and probably most efficient closest to the source. Fabrication most strongly impacts the intermediate tiers of supply chains.

Fabrication results in simplified logistics that result in dynamically allocatable resources. You simply ship the raw or ready-to-fab resources and then dynamically allocate them as goods when need. It’s like a cross between logistics and lazy evaluation a la functional programming. Dynamically processible, ready-to-fab materials are more useful.

Overpopulation and geopolitical instability will generally tend to rise commodity prices, thus prices and thus CPI, adding perceived inflation to inflation generated by monetary policy.

Technology’s Impact on Commodity Markets

Trends in commodity markets contribute to dynamics in demand. What technology is capable of delivering determines what resources nations need and thereby determines demand. Conflict theory describes how powerful groups and institutions respond to their anticipated need for resources.

The majority of uncapitalized opportunity in the next few decades centers around materials science and the resulting intellectual property. Both the import of resources from space and these new fabrication technologies will strongly disrupt commodity markets.

Once fabrication achieves specific technological functionality milestones, it always becomes more efficient to manufacture closer to the consumer. The greatest questions are simply when fabrication hits these milestones, what the phenomonological results of each milestone are and who controls the IP and production capacity when each milestone is reached.

With a bit of phenomonological calculus applied to technology (i.e. reflecting upon fabrication’s phenomological ideals), one assumes you feed raw materials and time to developed industrial capacity in order to receive finished product. The philosophic result is that the limits imposed by space begin to dissolve as the initial distribution of minerals accross the earth become paradoxically increasingly more and less determinant of economic trends.

That is all philosophical, of which the ideals are meaningless without knowledge of chemistry, physics and engineering. In order to make any rational predictions about the nature of fabrication technology requires an intimate knowledge of materials science, computational chemistry and many other fields.

What can be known simply is that there are physical limits imposed by counteracting entropy to transform materials. These fundamental limits cannot be surpassed and bound any solution. There are technological limits imposed by the transient capabilities of fabrication. There are computational limits of the fabrication processes. There are economic limits, resulting from the distribution of resources. In terms of economic trends leading up to 2050, the distribution of resources bounds, predicts and determines human economic behavior. If it weren’t for the possibility of resources in space, the system would be completely closed. Still, who controls the production and distribution of materials from space?

Higher commodity prices lead to development of resources from the arctic, the seafloor and space. Greenland and Antarctica are incredibly mountainous and their minerals are [probably] untouched. Furthermore, proficient fabrication technology will lead to a renaissance in garbage. All those landfills in third world countries become like gold mines … maybe. Of course, we’ll also see the obligatory gradual shift away from fossil fuels and towards renewables, as nations posture themselves for energy independence.

Distribution and Control of Foreign Direct Investment

New opportunities created by innovation in resource allocation logistics and new manufactuing technologies will undoubtedly impact globally allocated capital.

It becomes cheaper to manufacture closer to the consumer. Doing so benefits the economy of the consumer while retaining competitive advantage and control over intellectual property related to industrial processes. After a critical mass of fabrication development, suddenly the cost savings of centralized manufacturing are available everywhere that the resources are. This could drive a minor modality that leads to investment/divestment of capital in FDI, but it’s one of many dynamics.

In national emergencies, nationalization of FDI can result from political unrest, but this usually doesn’t happen in developed economies with strong rule of law and property rights. In response to international events or a currency crisis, there may be sale & redistribution of FDI assets to mitigate & relieve some impact to investment portfolios.

International Regulation of Supply Chains

The effect on how supply chains interact with the American and global economies. The scope and flux of changes to supply chains will be dependent on how quickly the intermediate links can retool their industry for changes in technology. The intermediate and higher nodes have the most agility to respond with more efficient business processes, whereas the process flexibility of the lower nodes is constrained to extraction & transformation of raw materials. The processes of these nodes are more geographically bound. The import of processed resources from space will not be so geographically bound, but it will remain terrestrially expensive until we have space elevators. New manufacturing techniques are enabled, required and sometimes rendered inaccessible in space.

Conflict minerals help finance destabilization and prevent economic development. Analytic data enables efficient reporting that enables greater and more complete visibility into supply chains. The interantional regulation of supply chains will determine investment behavior. There is this Harvard ILJ article from 2015 on regulation of international supply chains: Shining Light on Global Supply Chains. It is absolutely fascinating and, in terms of density of novel information, this single article may have accelerate my general level of knowledge more than any other writing I’ve ever consumed. It stimulated my imagination on how logistics are coordinated for manufacturing internationally, which opened up my understanding of how these businesses are structured.

Forex Dynamics and Foreign Currency Reserve Distribution

Amidst the automation crisis, where most developed economies must finance expansive entitlement spending with credit and printed currency, this leads to turbulent and unpredictable forex dynamics. These will be similar to those experienced around WW1 and WW2. Strong political influences that emerge as a result of forex markets, foreign currency reserve distribution and foreign debt holdings.

Forex trading and automated methods in particular will tend to capitalize on trends without appropriate understanding of the systemic nature of these fluctuations and the political consequences of major movements in the markets. These trading methodologies emphacize short-term gains and losses. It is very difficult for traders to operate in a systemic crisis. If inflationary monetary policy becomes adopted globally in developed economies, traders will try to capitalize on policy reports, commodity data and banking data, but will likely not see the systemic problems emerging until it’s too late. Understanding how commodity prices, banking data and central bank policy affects currency value and trading trends will be utilized as a method of control by governments who will try to take advantage of this crisis.

The Dollar’s status as the world’s reserve currency will critically cause the emergent political influences to be stronger and different in quality than for other currencies. Groups with significant US debt holdings or US currency reserves will attempt to influence American policy to suit their interests. We should be willing to cooperate, but prioritize our own interests first through forward-thinking economic policy.

We absolutely cannot solve this major economic crisis from the 2030’s. We must work to mitigate these consequences moving forward.

Basics of Fundamental Analysis in Forex Trading

The above is a great intro to trading tactics, as applied to Forex.

The effects of inflation on many currencies simulataneously will result in stronger behavioral dynamics of groups with significant currency reserves and debt holdings. High annual rates of inflation, as measured by CPI or monetary supply, will result in unpredicable turbulence in forex and debt markets. Depending on the policy responses to high unemployment, the inflation trends in various currencies and CPI’s will occur at varying rates, which opens up opportunity for speculation. Speculation on currencies will add to the turbulence. Positive feedback loops in the turbulence of forex markets, in the worst case, leads to runaway evaporation of wealth in entire nations.

Normally, perturbations in forex markets are limited in effect, but in this case, all developed nations will eventually need to finance the living expenses of unemployed citizenry with government spending.

Bond Markets React Poorly to Inflation

The Federal Reserve influences credit markets through the sale of debt securities. How does high inflation affect the willingness of the Fed and banks to loan with low-interest, if they are expecting inflation and/or significant forex fluctuations? High inflation negatively affects the bond market because the yields are depreciated by it.

How do bond markets respond in the 20’s & 30’s? Unemployment pressures bond markets to respond with lower yields. Further, investopedia states that “inflation is a bond’s worst enemy.” Bonds are long-term securities, whose value is supposed to be locked in by government policy. For a brief introduction to trading bonds, read this article on the Ten Year T-Bond and Why It’s Important.

The Fed buys bonds to inject liquidity into the economy, expecting to receive payment from bond issuers over the course of 10 or 30 years. Since bond investors receive less return on investment after bond yields are adjusted for inflation, the bond market responds poorly to inflation.

This means that the Fed is less able to leverage bond purchases to inject liquidity into the economy through the banking sector. It can still do so, but can expect the bonds to perform poorly and thus is a bad decision. High inflation will place downward pressure on liquidity via the bond markets. Furthermore, this happens while another feedback loop of poorly serviced debt via unemployment restricts liquidity through constriction of bank reserves.

Jeffrey Gundlach’s 2017 Presentation on the Bond Market

Unpredictable changes and shifting industrial dependencies in the commodity markets will alter composite measures which are used to predict trends. For example, for at least the past several decades, the price of oil and other commodities serves as an indicator of unfolding inflation in the CPI. Thus, it has served as an important metric for bond investors. Yet, oil’s capacity to indicate short-term inflation will break down or, at least, the relationship will change. Because investors will continue to use these correlative composite metrics without reassessing their assumptions in doing so, they will tend to misallocate capital.

Distribution of Debt

What happened during the 2008 housing crisis? The subprime housing markets crashed and the lost revenue streams thereof triggered cascading effects through the global banking system. But how did the subprime housing markets crash? An economic downturn that impacted the riskiest mortgage assets first.

Quite simply, there were people with mortgages who couldn’t pay their bills. This require shifts in allocation of liquidity to cover the lost revenue streams, which triggered recession and thereby increased unemployment, leading to more lost revenue streams in the housing sector.

In addition to income distribution, the distribution of debt among consumers and businesses in America is critical. The greater the unmet debt burden, the greater the effects of such a crisis are to be when they emerge. So, even if there is some policy like UBI that provides the median income, there will still be many people unemployed above the median income who are unable to pay their mortgages and debts.

As it intersects with the income distribution of the newly unemployed, this distribution of real asset debt like house and car loans, then triggers an impulse to sell amoung owners and mortgage holders. This results in downward pressure on home prices. If you don’t know what happens next, I’m not sure why you’re still reading and I would guess that you’re a liberal who decides their vote presented solely with emotional arguments.

Remember, in the best case, the government can maintain the median income, but without empire, it’s impossible for the government to drive this median income up. Are you a leftist who rails against American imperialism or American capitalism?

Entitlements, Median Income and Population Flux

How fast do disruption occur in income distribution and median income? Which segments of median income are disrupted first? At what rates can we expect disruption to progress in each income segment? At what rate can federal deficits be expected to expand? This will determine how reliant the government is on central banking, bonds, and more inflationary measures. Which segments of income distribution most severely affect aggregate revenue streams to banks from personal and corporate debt? Lower through upper middle class.

Inflationary financial policy like this, driven at high rates in the 2020’s, may increase the CPI at a rate faster or slower than the monetary supply. The fed tracks inflation with CPI. For example, the CPI may eventually begin to increase faster because of cascading effects in cost structure or pricing strategy. Businesses expecting inflation will respond by rising their prices to target future economic conditions.

“Ask not what your government can do for you, but what you can do for your government.”

What is the government obligated to provide to each citizen? What is the government obligated to provide for non-citizens and illegal immigrants? Did the government enact amnesty programs for illegal immigrants? Did it do so because of a certain political party’s long-term strategy to use the votes to stay in power?

How much do people contribute to their regional or national economy in return? How much can citizens who were formerly illegal immigrants be expected to contribute to GDP and tax volume? So what is their net contribution to the deficit? It should be expected to be higher than that of legitimate citizens, though at most amnestees would account for 5% of the population.

But, at some point, we have to decide who is American and who is not. If we will be compelled to respond with massive government programs when our tax revenues are cut by 20-50%, then who is our responsibility and who is not? This is not in any way a distinction to be made on a racial or ethnic basis. Yet, we must decide who receives the benefits of American citizenship and who does not. If the benefits to being American are attractive, how do you think foreign nationals will want to respond in a global crisis?

This is why I consider the Democratic platform to contain schizophrenic ideals. They want the government to provide more of everything, but are not willing to engage in a reasonable discussion on illegal immigration. They rail against perceived American imperialism and policies which promote American economic growth while expecting the government to do more for them always. This economic growth is precisely what makes their programs possible. Further, they want so badly to improve people’s lives, but do not understand how their policies will actually change human behavior. Their platform is concocted from idealistic policy that the leadership knows triggers emotional reactions within the population. All they have to do is promise more of everything and promise to adhere to the idealistic, emotional, irrational concerns of the base, without considering how they will deliver on their promises or whether their policies are sustainable and grounded in reality. It is irresponsible. They are gaming the democratic system with demogoguery to retain power and threatening that everything they offer will be taken away if they lose. In reality, if the Democratic platform prevails now, we will be blindsided by poor monetary and economic policy when this crisis happens, then America will lose everything. We will burn wheel-barrows full of cash in an economy that hopelessly resembles the Weimar Republic. The problem with letting them win is that radical leftists are already promulgating the idea that capitalism is at fault for any economic problems.

IMO, there are radical leftists who know this is coming, they want it to happen, they want to bottom to fall out and they want to tell you who to blame when it does.

Because the crisis inevitably results in inflation, population flux partially determines the severity of a currency’s contribution to disruption to forex markets. This happens when a government is forced to expand entitlement programs to account for new citizens. Because the economic crisis cannot be lessened except through credit directly added to government balance sheets, the more spending that is required, the more credit a government will require. Therefore, the more a government or party obligates itself to do and the more citizens it is obligated to provide for, the less it can do with the same amount of deficit. When this deficit is financed through credit, this furthers inflation. So therefore, the more people and the more entitlements, the faster these macroeconomic dynamics become toxic for a nation.

There are major differences in how this kind of credit-driven policy affects the currency and behavioral economic dynamics. In the nineties and the aughts, the credit stimulated the economy through the housing markets, which is a necessary means towards promoting home ownership. Therefore, if one manipulates housing prices and other aspects of the real-estate market, one can increase GDP and tax volume artificially through credit, when the monetary policy is seen as necessary for growth, sustainable and thus responsible.

When one begins to infuse a deficit ridden government with cash, it is not seen in the same light by creditors, investors and other backing nations. The effects in floating your economy are, on the surface, similar, but this latter method is unsustainable. At this point, you are about as close to literally printing money as you can get if you’re in charge of the world’s reserve currency.

Ultimately, if you want to reduce the severity of the crisis, you have to reduce spending while there’s plenty of liquidity. that means we need to divert from spending in general. again, that’s so that we can invest in other things while we have the liquidity because once unemployment hits critical levels, we won’t be able to do anything but print money. what matters is preservation of real value outside currency, so we need to invest in global real estate, commodity, production via FDI, etc. in this way, we can weather the forex dynamics.

Unpredictable Geoeconomic Trends Via Climate Change

In part one and part two of this series, I discuss leveraging the smart grid as an economic platform. Such a platform helps quantify/anticipate trends in demand for commodities, which can help mitigate a lot of the uncertainty in the late 20’s and 30’s. If we can economically respond to changing commodity prices faster because we are in tune with real-time production/consumption trends and thus supply/demand, then we can make better financial trades that reduce the possibility of divergent feedback loops in Forex and Commodity markets. This platform is incredibly useful for derivatives on commodities.

If you control/own the hardware, you have more control over the applications developed on top of platform’s like GE’s Predix. When combined with financial applications, this energy/resource/appliance utilization data is like God-mode for commodities.

Climate change can lead to feast or famine. In the period of time until 2050, we will see some area’s of the world increase in real-estate value and other decrease. However, the major changes to real-estate and agriculture will primarily occur to areas of the world where such changes were unexpected. Thus, we will need to reallocate agricultural resources and this may lead to rising food prices. Further, even without climate change, water shortages are almost a near certainty. This leads to rising energy costs in agriculture and its requisite infrastrucure and thus rising food costs. War will be fought over food, water and the climate.

War will cause massive amounts of pollution. Wide scale war with new technologies in the age of climate change can lead to debt and more war in some circumstances. The debt or climate damage itself could provide casus belli.

Furthermore, financing war in the middle of an economic or currency crisis is difficult if not impossible. Hey, maybe we can find Lincoln’s buried gold. Oh wait, that’s just a metaphor for inflationary monetary policy in a time of crisis.

That one thing you were counting on that your opponent knew you would reach for…

How does war impact bond markets? Limited savings rates prevent private citizens from investing in wartime bonds. Gradually limited savings are a hallmark of credit-leveraging Keynesian policy. Such policy gradually increases the price of services and thus, decreases savings rates.

We Are Not Out of the Woods Yet

Just because the economy seems to have recovered from the 2008 crisis doesn’t mean that we’re out of the woods yet. We need forward-looking economic policy determined by where the global economy is heading. Amid the uncertainty imposed by these ten factors, each strongly defining how the crisis unfolds, the successful policy is not reactive, it is proactive. It must drive trends and mitigate uncertainty, while being strongly defined by exigent trends and the Singularity’s assymptotic finality of economic convergence.

Policy Must Account For Domestic and Foreign Political Reaction

Policy must also expect the domestic and foreign political reaction, as well as the tendency of the masses to be completey unaware of the economic reasoning behind policy. Policy must also attempt to construct the proper narrative moving forward, so that citizenry living in democracy actively support it.

Counting on Downward CPI Pressure is Wishful Thinking

Good news: some prices will generally lower over time via improved technology. Downward pressure in CPI results as fabrication disrupts intermediate tiers in supply chains. This is like a phase change with emergent behaviors, but enabling more new dynamics than an physical phase change. Fabrication tech enables mitigation of risk against industrial allocation by enabling faster response to supply/demand. This adds another layer of downward price pressure by enabling targeted supply/demand response.

However, I don’t think the CPI will lower enough to offset monetary inflation. Further, monetary inflation is fueled primarily through the housing sector, so as housing prices rise, this means credit becomes more available to central banks and lending institutions. As housing prices rise, this makes things difficult for renters and prospective owners: the percentage of available income *after paying bills in a services-oriented economy gradually becomes less. Even if, commodity prices and production, both primary and intermediate, initially produce downward pressure in prices, commodity prices will inevitably rise due to overpopulation and competition.

Counting on protracted downward movement in CPI to offset monetary inflation with lower perceived inflation is wishful thinking. This second-order effect is a favorite for people promoting inflation-based economics. UBI supporters love citing this one.

Avoid Hacking Economics for Short-Term Gain

When we hack the economy to optimize macroeconomic indicators, we often delude ourselves into believing optimal indicators imply prosperity and optimal allocation of wealth. That is, the common person assumes that the cash flowing around the economy reflects strong economic fundamentals when instead Keynesian economics allows “even out” economic turbulence by stimulating the economy with central banking. The credit injected into the economy, in turn, promotes economic growth. So when there’s not enough liquidity in the system, one uses central banks to pump it in.

There’s nothing inherently wrong with Keynesian economics, but there’s a tendency for these policies to go horribly wrong. If we pump credit into the economy, but don’t invest it in the right places, it’s going make everything worse later on. However, we need to avoid the tendancy to hack the economy using Keynesian economics. For example, the factors that led to the housing crisis were essentially an attempt to hack macroeconomic indicators to drive consumerism, maintain GDP growth and promote an artificial sense of prosperity that would lead to high spending. The flood of cheap credit into domestic industries such as construction floated these industries and kept a healthy flux of liquidity flowing through the economy. This artificially increased employment, since the broader availability and utilization of capital keeps people working and, thus, servicing their debts.

Yet, if we are “banking” on these same strategies to float macroeconomics via injection of liquidity/credit, then more we depend on them, the greater this future crisis will be. Macroprudential policies should limit problematic behavior via central banks. The Bank of International Settlements is a great source of information on macroprudiential policy worldwide.

Strategic Allocation of Liquidity in the 2020’s

We must assume that we have a finite amount of liquidity flux to invest in a platform for economic development before unemployment ends up restricting liquidity. We need an economic engine that harnesses the differential in progression of unemployment and other geoeconomic aspects of the crisis.

Automation occurs in developed economies first, where the economic platform exists, but there is economic opportunity for developed players to help build that platform elsewhere. This enables future opportunites for investment, though if the utilization of liquidity flux is not properly allocated in the initial stages leading up to the automation crises, these opportunities in developing countries will begin to ripen when liquidity is restricted via unemployment.

We need to maximize our launchpad time and try to stave off unemployment because the entitlement programs and lost tax revenue streams cause the greatest change in monetary policy. We need to be creative in searching for solution and try to articially replace the sociocultural evolutionary dynamics that we lose from automation. The next generation must always be stronger. The best usage of our launchpad time can be guaranteed through appropriate investment of liquidity while we have it, before it becomes constricted through macroeconomic, bond market and forex market response to policy.

Interest Rates And Federal Reserve Policy

Interest rates will affect lending behavior, which can increase or reduce the total consumer and corporate debt. When unemployment spikes as a result of automation, these revenue streams must be accounted for by diverting liquidity. So, if the total amount of debt that must be accounted for is lower after a decade of lower interest rates, this means less liquidity will need to be diverted later on.

It’s not that a slowdown in lending via lower interest rates will be necessary. It’s that we need to make wiser investment decisions that weigh the long-term economic consequences much more heavily than the short-term. Lending institutions cannot simply conduct themselves with the next quarter’s results in mind.

International Economic Development

In terms of maximizing profits, American and multinational banks will almost certainly tend to avoid developing markets because of the higher risk and lower returns, but if they do so, this doesn’t establish an economic platform that America can use to replace liquidity in the 2030’s.

OPIC is an international development organization which would truly help. It’s a rare breed among government institutions and actually turns a profit. Something or some mechanism like it is needed to help facilitate investment while we have launchpad time. However, the Trump administration recently put OPIC on the chopping block.

CSIS Discussion on OPIC’s Role in Emerging Markets

We must have something like it that prepares us for expansion into foreign markets. We must decimate the chaotic forces that prevent economic development in third-world countries.

Currency Market Stabalization

There’s a strong need to artificially stabalize the currency markets if we know there are to be problems in the future. After the crisis begins, it is unlikely that we can coordinate nations to come together and cooperate towards this end. They will be acting in their own self interest under rapidly changing conditions.

What can be used as force for forex market stabalization or correction? How can we identify these potential feedback loops, while anticipating the response of financial markets?

Could there be a system of international agreements for redirectable labor/development funds that isn’t locked to a major currency? This could be used to recorrect the value of liquidity for significant short-term changes to currency value, so that investments and economic development projects can continue over the course of months or years without stalling out. How can such an international system be architected to offset significant forex turbidity?

‘Ethereum for IRL Labor’ as a Currency Stabilization Mechanism

Another option is a single currency shared across the world. However, this will never happen in time as there is no reasonable transition path towards this system. Doing so is impossible to do safely. The transition to the system would cause too much socioeconomic instability. And that’s without considering that an unproven, ideal single-currency system might not work.

Yet, a currency doesn’t quite fit the bill for what I’m thinking about. The concept of Ethereum as applied to IRL labor and industry is more along the idea of an international mechanism for offsetting major liquidity and forex fluctuation problems. I don’t know what would work, but it is clear there is a problem and a major need to solve that problem. Now, if we could just find some Harvard-educated international law practitioners with strong skills in financial/monetary policy to follow that pipedream down the interdimensional rabbit hole…

Update: SDR is a mechanism in place for balancing turbulence in international currency markets. The IMF has an SDR backed by a basket of five currencies. The IMF also plans on replacing the dollar as the world’s reserve currency with the SDR, which would decouple the petro-dollar. In order to expedite this transition, the IMF would likely react to an international debt crisis. The video below contains more information on the SDR as it relates to monetary policy.

Chicago Economics Society - IMF SDR: An Emerging Global Currency?

Flexible Management of Existing Debt

Neither UBI/ELR accounts for consumers’ need to maintain existing cash flows to service debt. This is a major problem for sustaining liquidity via central banking and the banking sector. Consumers with jobs in automatable roles can no longer pay their mortgages. This is another feedback loop that generates problems system-wide. The higher consumer debt appetite are the greater the disruption will be to banks sources of revenue in the future. Poorly managed credit practices will lead to a greater scale of liquidity problems in the 2030’s.

We should probably make the home & garden channel illegal, as well as pay-day loans and commercials advertising predatory lending practices. That statement is facetious, of course. We should encourage higher payments of existing debt while the economy permits. That, however, doesn’t work well for our ironic consumer-driven economy.

Enslavement by Debt and Desire

In a society where most people receive universal $10,000/year UBI payments, how does the person who formerly made $200,000/year pay their debt? Can they ever? Or, when the crisis hits, is each person forever enslaved by their debt to the degree that their desire for material comfort expanded their debt appetite? Does this mean the person with zero debt is best prepared for the upcoming crisis?

This is unlike any depression in history because, for those at the top, there is high growth and economic opportunity is plentiful. Yet, for everyone else, there is little to no economic opportunity, except as artificially provided by the government or those with liquidity and a penchant for unnecessary spending. In this depresson, people may owe large sums of debt that the economy does not help them to repay. In severe cases, the borrower is unable to pay even the interest on their debts. So, how do society and government respond to enable these debts to be paid?

Student Load Reform and Innovation in Higher Education

Student load reform in the short-term is reasonable, although innovation in higher education is preferable. We do not want our children to be forced to indebt themselves with massive sums of money if the economy isn’t even going to allow them to repay it. At the same time, we do not want to remove the incentivization for education.

We know that technology should revolutionize education in general. To me, the greatest value to higher education, as its currently formulated, are the social networks formed by someone’s years in college. This is what online education can never replace.

If a college degree’s value diminishes over time and student debt becomes unnecessarily high, we will see many people begin to withdraw from higher education. We need education. If there’s one thing that should be covered by national service, it is education, though perhaps not initially. Technology will replace people’s desire and instinct to learn, especially if it is not rewarded economically.

Even With Inflationary Measures, There is Still Systemic Collapse

The easy way out of a deflationary crisis is to coordinate government policy to create higher monetary inflation. Here, we have a problem: we need CPI and monetary inflation to be paradoxically low and high. There are many such paradoxical factors that I have discussed in this article. We cannot simply hope for everything to land in our favor and we certainly cannot have both outcomes of such paradoxical factors. i.e. both low and high monetary inflation or both low and high perceived inflation via CPI.

It may be tempting to leverage inflation to lessen the magnitude of consumer and corporate debt, but financial institutions will strongly oppose this. The people, however, will push for whatever they believe will ameliorate their suffering in the short-term, without regard for the long-term. In the above situation, people are pitted against the financial institutions at a time of unrest. The people will not care to understand and will look to people who tell them what they want to hear. Inflationary policy on a global scale is what causes the forex problems and it is what will cause large sums of wealth to evaporate in a forex crisis. That is the last thing banks or governments want.

Gold and Silver

Because the only way to lessen the magnitude of the crisis is via inflation, investment in gold/silver are good bets. For smalller investors, as this approaches, I’d recommend up to 1% investment in gold/silver per 1% in unemployment. The problem with this is, if everyone does it, it reduces the liquidity available even further. So, you have your money in gold and silver, but it’s not liquid and can’t finance anything.

Exacerbating problems, banks can only lend in proportion to their reserves accumulated partially from savings. A contraction in reverves through annhilated savings means another source of contraction in liquidity. Inflation is the devil. And especially high monetary inflation.

Policy Must Account for Disinformation in the Age of Social Media

We must keep in mind the shifting nature of information amid social media, as well as the difficulty in avoiding complete communist revolution. Hyperconnectedness and the light-speed velocity at which ideas travel on the internet disrupt our ability to discern causality. That is, no one can determine cause and effect in political or sociocultural affairs. Therefore, it’s anyone’s game when constructing a narrative.

Far left radicals will encourage the pursuit of poorly thought out policy that causes the bottom to fall out and they will harness the political momentum that results from economic chaos. They will distract the masses from understanding the true causes of the economic crisis, favoring to ideologically place the blame on capitalism. While it may be a herculean task, I recommend scorching each neck of that hydra with a blazing firebrand. The more radical leftists will not hesitate to use each economic setback as a means to gain ground while setting us back further. It will distract us from executing a coherent strategy.

Revolution is Expensive and the Opportunity Cost is Unacceptable

Groups planning to capitalizing on the economic chaos by rewriting the narrative to undermine the American economic system are leading us right off a cliff. Revolution involves transfer of power and of assets, either legally, nomininally or just functionally. That’s how Marxist revolution works. That transfer is incredibly expensive and wasteful.

It’s not a matter of opinion. There will be economic crisis and any friction or discord in America’s reaction is unacceptable. America must unite and we cannot tolerate dissension or we will end up ceding our own economic interests to our enemies at the culmination of human history. America underneath the foot of our enemies will be unrecognizable. You will not receive the social programs you are looking for because our government, with a ruined currency, will not be able to afford them. So, if you disrupt our fountain of prosperity or our path forward, America will destroy you.

We completely anticipate a fifth column to emerge. If warranted, we will funnel antagonistic forces within America into a single movement and we will break your back. At that point, you might say that we are counting on it. The economic tensions will need someone to blame and, with data science, we can determine those advocating to undermine American interests. We will scapegoat communists as an Ouroborosian alchemical cost to galvanize America, in the name of safeguarding our interests.

As we approach the Singularity and phase out the workforce, Marxism’s semiotic basis of symbols related to work and pride in work begin to break down. Your pattern language no longer functions for mind control because the symbols upon which it is built become increasingly irrelevant to human experience.

What Side Do You Want To Be On Anyways?

This is a potentially currency-breaking economic crisis. China, Russia and others already have plans in place to replace the American Dollar as the world’s reserve currency. It’s called BRICS. If you believe that life will proceed swimmingly after our economy and currency are broken, a new world order of Chinese hegemony is established, and that none of this will interfere with America’s ability to implement expansive social programs or protect foreign policy interests, then you might have a severe head injury.